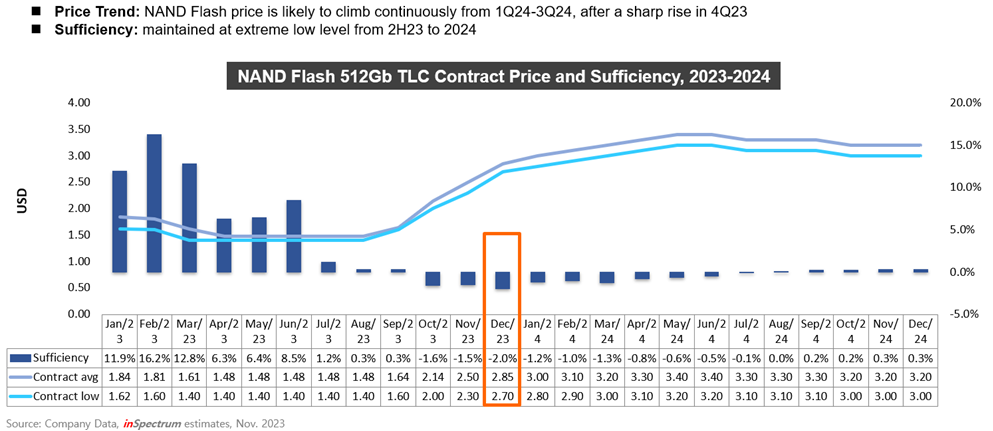

The NAND Flash market is bracing itself for a significant shift, with industry leaders like Samsung, Kioxia, SK Hynix, and Micron facing challenges in reaching the breakeven point. Despite a recent rebound, prices still fall short for these key players.

🔍 Market Insights:

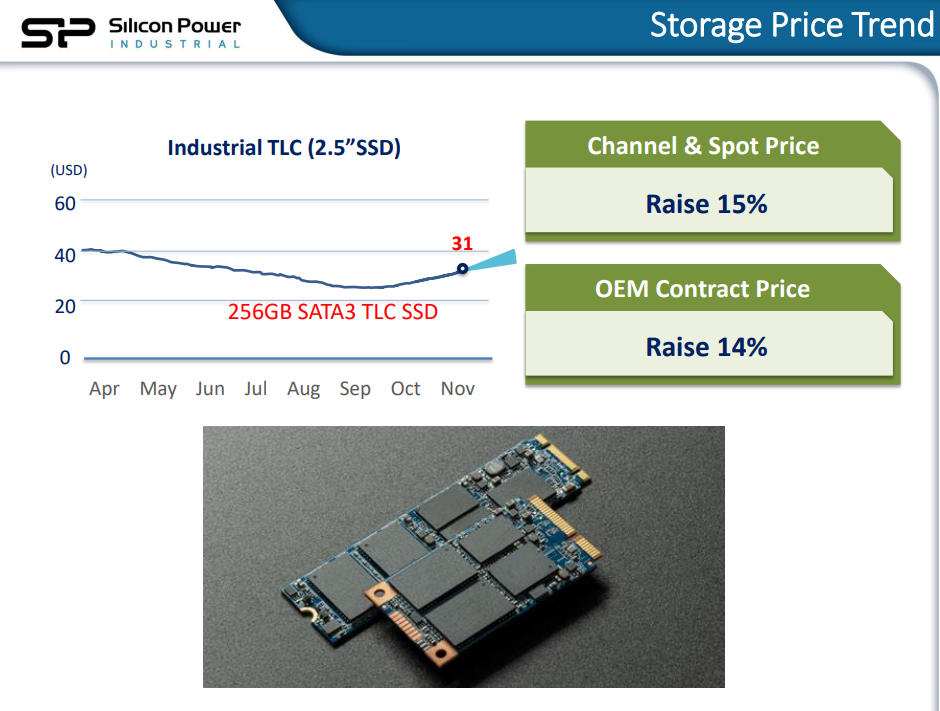

After a recovery from a decline in NAND prices, the industry is buzzing with expectations of a 50% price surge in the short term. Even after a 40% increase, major manufacturers may only break even, highlighting the intense pursuit of profitability.

📊 Global Market Snapshot (3Q23):

Samsung leads with a market share of 31.4%.

SK Group follows at 20.2%.

Western Digital secures the third spot at 16.9%.

Kioxia holds the fourth position with a market share of approximately 14.5%, as reported by TrendForce.

🔄 Adapting Strategies:

Recognizing the lower profitability of NAND Flash compared to DRAM, international giants like Samsung are actively reducing NAND Flash production. For instance, Samsung has cut NAND chip production by 50% since September, with plans to gradually increase prices in 2024.

💡 Insights from TrendForce:

Following Samsung's reduction, other suppliers are also strategically limiting wafer allocations. The industry is now experiencing a structural supply shortage, giving chip manufacturers control over prices. Despite this, buyers are maintaining high inventory levels, contributing to a dynamic market.

📈 Future Outlook:

While quarterly contract price increases seem substantial, achieving a complete turnaround is still in progress. Expectations are that prices need to surge by an additional 40% to allow suppliers to cross the breakeven point. Brace yourselves for a robust market in the coming quarters.

For additional reading:

Western Digital to raise NAND flash prices by up to 55%

https://lnkd.in/dAb_9stV